New BOI Reporting Requirements

Starting January 1, 2024, all domestic and foreign entities that have filed formation or registration documents with a U.S. state will be required to report their Beneficial Ownership Information (BOI) to the Financial Crimes Enforcement Network (FinCEN), including information about the entity itself and two categories of individuals - beneficial owners and company applicants.

A beneficial owner is generally someone who owns or controls at least 25% of a company or has substantial control over it, while a company applicant is the individual responsible for filing the documents that create or register the company. The goal of this requirement is to challenge and dissuade bad actors from using shell companies to hide their illegal earnings and help law enforcement identify and root out who is behind them.

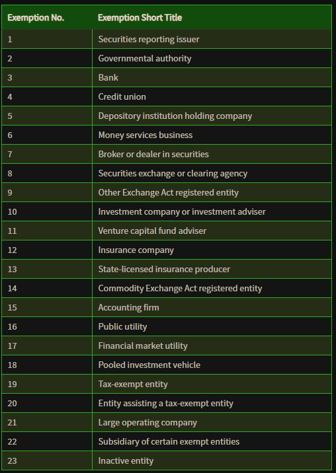

BOI reports must be electronically filed using FinCEN’s secure filing system starting January 1, 2024. Companies created or registered before this date have until January 1, 2025, to file their initial reports, while those established on or after January 1, 2024, must file within 30 days of their creation or registration. Not all companies need to report BOI. Only those meeting the definition of a "reporting company" and not qualifying for an exemption are required to report.

More details about BOI:

- Implementation and Regulation Details: The Reporting Rule, implemented on September 30, 2022, is part of Section 6403 of the Corporate Transparency Act and is detailed in title 31 of the Code of Federal Regulations (CFR) under section 1010.380.

- Consequences of Non-Compliance: Failure to report or providing false information can result in civil or criminal penalties. This includes fines and potential imprisonment for willful non-compliance or submission of fraudulent information.

- Identifying Beneficial Owners: Reporting companies must identify beneficial owners, which include individuals who exercise substantial control or own/control at least 25% of the ownership interests. Companies might have multiple beneficial owners, and all qualifying individuals must be reported.

The FinCEN has provided the Small Entity Compliance Guide to help small businesses comply with the BOI Reporting Rule, understand the requirements and procedures for filing BOI reports, and be aware of the various exemptions available to different types of entities.

The guide includes chapters addressing key questions, interactive flowcharts, checklists, and other aids to help determine if a company needs to file a BOI report and how to comply with the requirements. It will be updated periodically with new information.

- Purpose of the Guide: The guide aims to assist small entities in understanding and adhering to the new requirements of the BOI Reporting Rule, with a focus on simplifying the process and reducing the burden on small businesses.

For small business owners, it is crucial to understand these requirements and ensure compliance by the specified deadlines to avoid penalties.